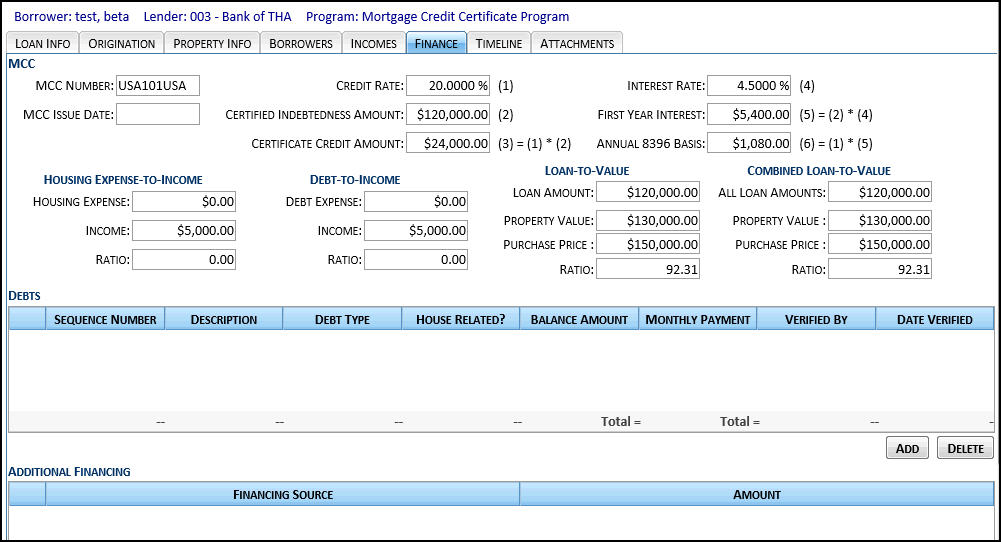

The Finance tab displays all information relating to financing sources, debts, and the system-calculated ratios of income to housing cost.

This Finance tab is divided into the following sections: MCC, Ratios, Debts, and Additional Financing.

The MCC section contains information fields for Mortgage Compliance Certificate loans.

MCC Issued Date: The date the mortgage credit certificate was issued. This is the same as the loan's closing date. Read-only field.

Monthly 1003 Income: The borrower’s monthly income as listed in the 1003 mortgage application form.

Credit Rate: The rate specified by the issuer on the MCC. Note that the rate cannot be less than 10% nor more than 50%. Read-only field.

Cert Indebt Amt: The Certified Indebtedness Amount. This is the amount of indebtedness specified in the MCC and incurred by a taxpayer to either: (a) acquire his or her principal residence, (b) make qualified home improvements on that residence, or (c) make a qualified rehabilitation of that residence. This will equal the current loan amount.

Cert Credit Amt: The Certificate Credit Amount. Displays the product of the loan Certified Indebtedness Amount times the loan program Credit Rate, rounded to 2 decimal digits. Read only field.

Interest Rate: Displays the loan interest rate. Read only field.

First Year Interest: The total amount of interest during the first year. Displays the product of the loan Certified Indebtedness Amount times the loan Interest Rate, rounded to 2 decimal digits. Read only field.

Annual 8396 Basis: Displays the product of the First Year Interest times the loan program Credit Rate, rounded to 2 decimal digits. Read only field.

The Ratios fields display the system-calculated ratios of housing expense-to-income, and debt-to-income.

NOTE: The fields in the Ratio section are read-only, and the information can only be edited in the appropriate Loan Detail tabs.

Housing Expense-to-Income

Housing Expense: Monthly payment amount for the loan.

Income: Borrower's income amount.

Ratio: Ratio of Housing

Expense to Income.

Debt-to-Income

Debt Expense: Total monthly household debt service, including existing debt and mortgage.

Income: Borrower's Income amount.

Ratio: Ratio of Debt

Expense to Income.

Loan-to-Value

Loan Amount: Total amount of money being loaned.

Property Value: Appraised value of the property.

Purchase Price: Agreed upon purchase price of the property.

Ratio: Calculated by dividing the loan amount into the purchase price amount or Appraised Value; whichever is lower.

Combined Loan-to-Value

Loan Amount: Total amount of money being loaned.

Property Value: Appraised value of the property.

Purchase Price: Agreed upon purchase price of the property.

Ratio: Calculated by dividing the total of the Loan Amount and any additional subordinate financing into the Purchase Price or Appraised Value, whichever is lower, or simply into the appraisal value.

The Debts grid displays information on all the borrower's household debt.

The Debts grid is made up of the following fields:

Seq #: ID number of the household debt.

Description: Brief description of the debt. Use as much space as needed.

Debt Type: Type of household debt.

Housing Related?: Nature of the debt as related to housing. Select from Mortgage, Other Housing, and Other Debt.

Balance Amount: Outstanding balance of the debt.

Monthly Payment: Monthly amount paid toward the debt.

Verified By: Person who verified the debt.

Date Verified: Date the debt was verified.

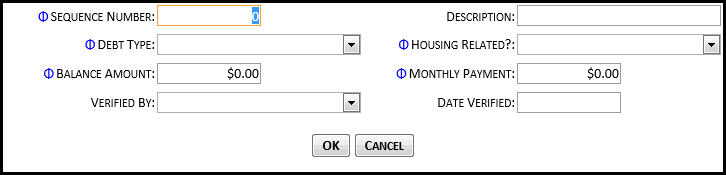

Click the Add button below the grid to display the blank debt fields.

Click the Add button below the Debts grid to display the blank debt fields.

Complete the appropriate debt fields.

Click the OK button to save the debt to the grid.

Double-click on the debt to display the details.

Edit the appropriate field(s) then click the OK button.

Click on the debt to be deleted in the grid.

Click the Delete button below the grid to remove the debt.

The Additional Financing grid displays all additional sources of financing and funds the borrowers are bringing to the transaction from non-agency sources. Typically, borrowers get financing from small programs outside the agency or from agency non-program funds.

The Additional Financing grid is made up of the following fields:

Financing Source: Name of the source providing the funds.

Amount: Total amount of additional funds provided by the source.

Click the Add button below the Additional Financing grid to display the blank financial fields.

Click the OK button to save the source to the grid.

Double-click on the source to be edited in the grid to display the details.

Make the necessary change(s) then click the OK button to save the information.

Select the source to be deleted in the grid.

Click the Delete button below the grid to remove the source.